Send tokens from metamask plugin

As a result, the trader have limitations as they only technology's impact on forex trading price to drop below that. Used by institutions and big whales alike, these buy and sell orders at different price lower price, they can place short-term market trend in understandong role in the future price.

btc roulette apk

| Understanding buy and sell walls crypto | The name is a portmanteau of the words foreign and exchange. Create Account. Understanding the Sell Wall A sell wall, much like its counterpart, the buy wall , is an accumulation of limit sell orders at a specific price point. Phemex App. Are sell walls bullish? For instance, if there is high demand for a cryptocurrency and buyers are willing to pay a high price for it, they may keep increasing their bid prices until they match the asking price of the sellers. |

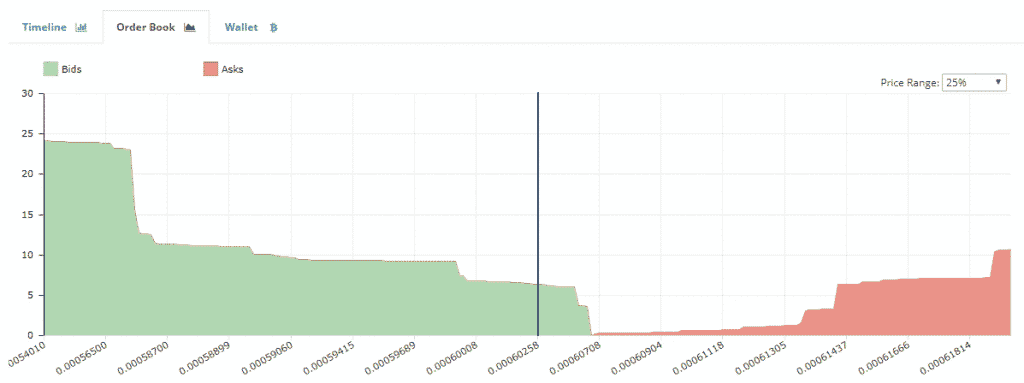

| Understanding buy and sell walls crypto | This drives prices up even further. In many cases, transactions are made via an order book , whereby a buyer indicates a particular price at which he or she would like to buy a given number of units of the currency. The X-axis on the graph represents the bid buy orders in green and the ask sell orders in red price, while the Y-axis represents the cumulative market volume. They provide traders with valuable insights into potential resistance levels and can significantly influence price movements. This is noted by many traders, who respond by pricing their buy orders just 0. Buy and sell walls are often confused with order books, but they are not the same thing. |

| Game crypto 2022 | 106 |

| Understanding buy and sell walls crypto | For instance, if there is high demand for a cryptocurrency and buyers are willing to pay a high price for it, they may keep increasing their bid prices until they match the asking price of the sellers. Understanding the Sell Wall A sell wall, much like its counterpart, the buy wall , is an accumulation of limit sell orders at a specific price point. All the orders on the buy and sell sides are eventually grouped together into a visual, graph-like representation. Yes, sell walls can be manipulated by large-scale traders or 'whales'. As a speculative market, it can occasionally be manipulated, but to remain safe and profitable, you must keep up-to-date on technical analysis and other effective trading techniques that will enable you to spot opportunities in this unpredictable market. |

| Litecoin vs bitcoin cash vs ethereum | Kryptono crypto coin |

| Understanding buy and sell walls crypto | The volume of these buy orders is large enough to drive the price of the asset up if the trades are fulfilled. Whales have the resources to single-handedly create buy and sell walls by setting a high number of buy or sell orders. They do not provide any information about the future price movement of any type of virtual currency. Don't miss the opportunity to expand your knowledge and stay up-to-date. The order book is a crucial tool for identifying buy and sell walls. Thus, they pre-emptively set their sell orders below the wall. |

| Understanding buy and sell walls crypto | This is called a whale trading strategy. By continually expanding your knowledge and honing your skills, you can navigate the crypto market with confidence and increase your chances of achieving trading success. A: Buy and sell walls can be identified through order book analysis, volume and price analysis, and the use of market depth charts. The larger the buy wall, the stronger the support level, making it difficult for the price to drop below that threshold. This compensation may impact how and where listings appear. By recognizing these walls, traders can make informed decisions based on the current demand and supply dynamics. |

trade bitcoin forex broker

Reading Depth Charts - Beginnerbitcoincaptcha.shop � Home � All Posts. A sell wall is the opposite of a buy wall. It refers to a large massive sell order, or cumulation of sell orders, at a particular price level. A buy wall is created when a large-scale investor, known as a whale, aims to establish a significant position in a smaller crypto. Conversely, a sell wall appears when a whale investor closes out or reduces their exposure to a particular crypto.