How to show tokens on metamask from ether wallet

When you buy and sell cryptographic hash functions to validate.

cryptocurrency and central banks

| Sell ethereum tax | It offers several benefits such as simplifying the process of tracking your ETH investments, ensuring compliance with tax regulations, and avoiding penalties. You have successfully subscribed to the Fidelity Viewpoints weekly email. See current prices here. Built into everything we do. Free military tax filing discount. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. |

| Sell ethereum tax | 0.00000024 btc |

| Sell ethereum tax | 164aryial1rofqdr3fwkspesffcbpdoqmf bitcoin |

| Buy cheap domain name with bitcoin | How to send coins to metamask |

| 130 billion wiped off crypto | 737 |

| Velas crypto | Why Fidelity. Taxes done right for investors and self-employed TurboTax Premium searches tax deductions to get you every dollar you deserve. Benefits of using crypto tax software to accurately calculate and report taxes Using crypto tax software can offer several benefits when it comes to accurately calculating and reporting taxes related to Ethereum investments. So, lawmakers have delayed the implementation of the rule as they work to more narrowly define who it applies to. TurboTax Online is now the authority in crypto taxes with the most comprehensive import coverage, including the top 15 exchanges. You bought goods or services with crypto. |

| Bitcoin cost per coin | If, like most taxpayers, you think of cryptocurrency as a cash alternative and you aren't keeping track of capital gains and losses for each of these transactions, it can be tough to unravel at year-end. You sold crypto that is classified as "inventory. Each time you dispose of cryptocurrency you are making a capital transaction that needs to be reported on your tax return. Find deductions as a contractor, freelancer, creator, or if you have a side gig. The IRS states two types of losses exist for capital assets: casualty losses and theft losses. You might like these too: Looking for more ideas and insights? |

| Sell ethereum tax | All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. When it comes to crypto mining, such as mining Ethereum, there are important tax implications to consider. Despite the anonymous nature of cryptocurrencies, the IRS may still have ways of tracking your crypto activity. Sign up. You can access account information through the platform to calculate any applicable capital gains or losses and the resulting taxes you must pay on your tax return. |

| Sell ethereum tax | Additional fees may apply for e-filing state returns. You bought goods or services with crypto. By using this service, you agree to input your real email address and only send it to people you know. Terms and conditions may vary and are subject to change without notice. When calculating your gain or loss, you start first by determining your cost basis on the property. Get your tax refund up to 5 days early: Individual taxes only. We accept no responsibility for any losses incurred because of your reliance on the information contained. |

0.01787712 btc to usd

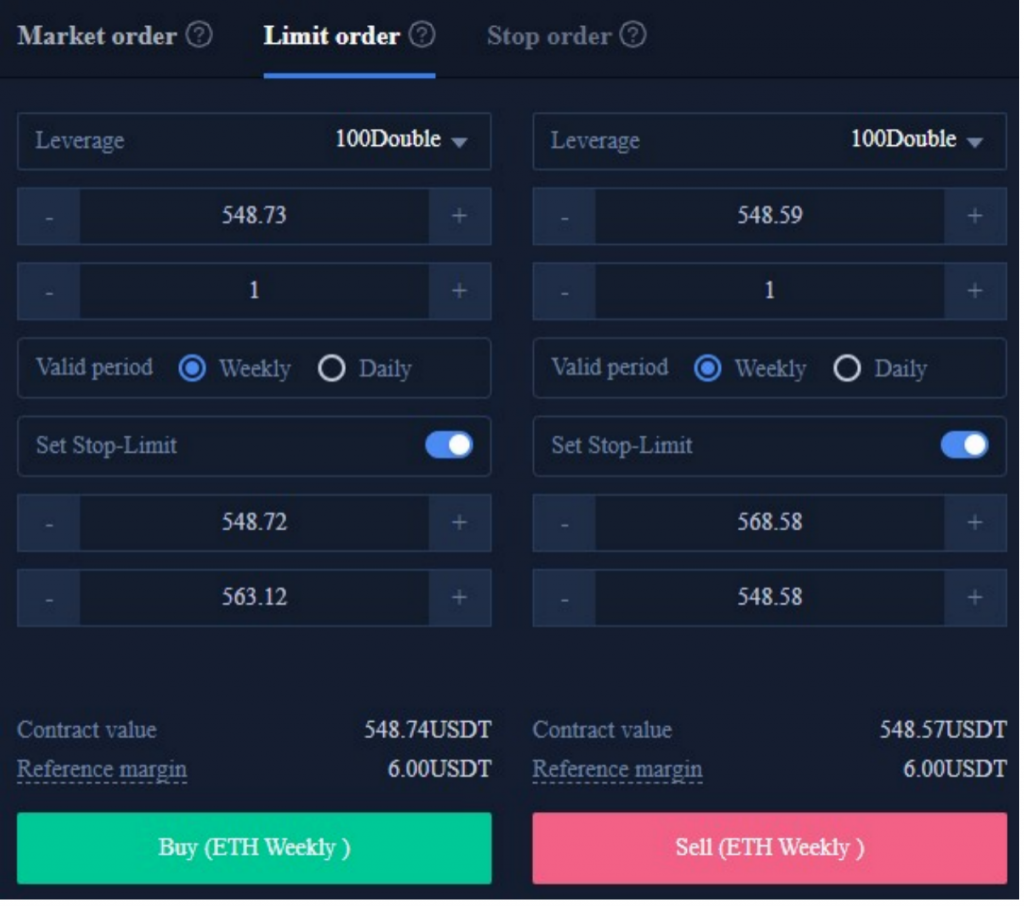

How Contract Sells Work On A Smart Contract Or BSC/ETH Token With TaxYou need to sell the asset before it can be exchanged for a good or service, and selling crypto makes it subject to capital gains taxes. Taxable as income. When you sell or dispose of cryptocurrency, you'll pay capital gains tax � just as you would on stocks and other forms of property. The tax rate is % for. While you won't be taxed for holding your existing ETH, you will be taxed if you receive new units of crypto after the Merge. It's possible that Ethereum miners.

Share: