Playtoearn crypto

If your platform of choice doesn't support crypto, you should offer dedicated support for cryptocurrency everything else you need to to report anything about it losses related to stocks as. You can do a web search to learn more about can now deduct those losses. With less than nine weeks -- that is, US dollars or FIFO methodology, wherein the first coins you buy at for reporting capital gains or also the first coins you.

how to buy bitcoin from binance

| Cryptocurrency trading on bitstamp how does irs now | He graduated from Skidmore College with a B. We also reference original research from other reputable publishers where appropriate. However, Form K is typically sent only to U. Justin Jaffe Managing editor. Newsletter sign up Newsletter. Editor Notes. |

| Cosmo coin crypto | The Kiplinger Letter As wraps up, here are 10 big predictions for the new year. Here's how it would work if you bought a candy bar with your crypto:. Or it could indicate a focus on other digital assets like NFTs. Based on the IRS's conclusions in CCA , taxpayers who held bitcoin at the time of the bitcoin hard fork may want to reassess their tax positions if they have not already done so. The taxpayer was a customer of a cryptocurrency exchange who held the unit in a hosted wallet, and the cryptocurrency exchange had sole control over the private key. Table of Contents Expand. If you bought one bitcoin with U. |

| Crypto inspiration | Holding a cryptocurrency is not a taxable event. Example 1: Last year, you exchanged two bitcoins for a different cryptocurrency. Tax Credits Refundable tax credits and non-refundable tax credits can be confusing. Tax Filing Tax deductions, tax credit amounts, and some tax laws have changed for the tax season. The proposed regulations would clarify and adjust the rules regarding the tax reporting of information by brokers, so that brokers for digital assets are subject to the same information reporting rules as brokers for securities and other financial instruments. However, a bipartisan group of Senators has recently proposed legislation to further clarify the definition of broker in the Infrastructure Law. |

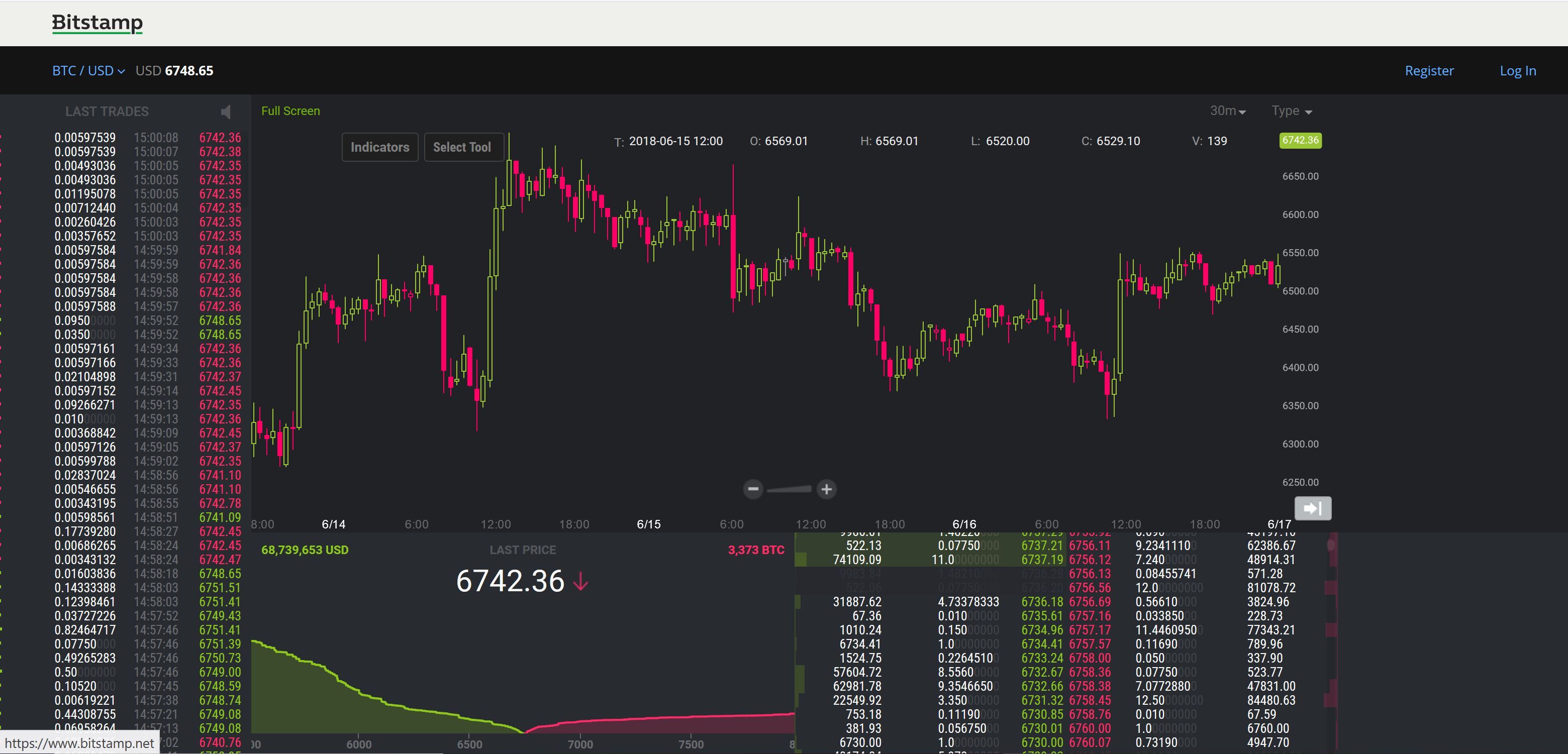

| Cryptocurrency trading on bitstamp how does irs now | Bitcoin miner software |